Today’s chosen theme: Strategies for Managing Tax Compliance. Welcome to a practical, encouraging space where smart planning, simple tools, and clear habits turn tax pressure into confident, repeatable routines. Subscribe to stay ahead with fresh, actionable strategies every week.

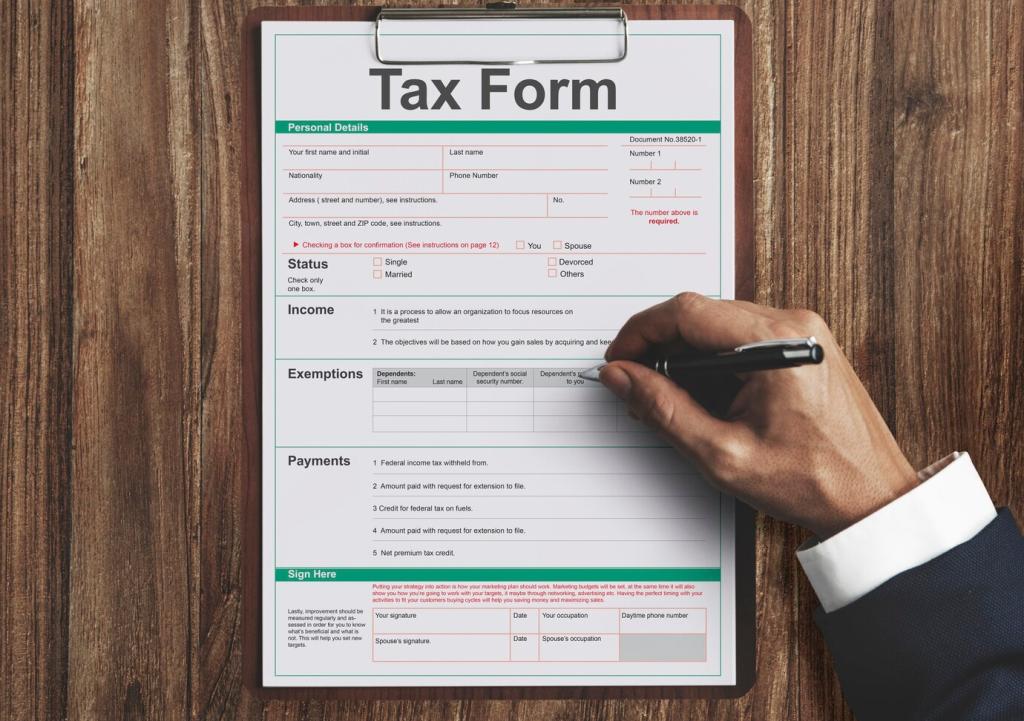

Laying the Groundwork: Your Tax Compliance Strategy Map

Map every filing, payment, and notice by jurisdiction, frequency, and method. Include owners, review steps, and backup reviewers for vacations. One client avoided a costly penalty simply by adding a pre-deadline checklist. Want our template? Comment, and we’ll share it.

Choose Technology That Reduces Error, Not Just Clicks

Pilot tax engines and e-filing tools with real scenarios before committing. Look for reconciliation features, jurisdictional updates, and role-based approvals. A startup we advised cut adjustments by half after a two-week pilot. Tell us your stack, and we’ll suggest quick wins.

Integrate Data at the Source

Capture tax-relevant fields where transactions begin: customer location, product taxability, exemption certificates, and shipping terms. Upstream accuracy shrinks downstream clean-up and audit exposure. Have data gaps? Post a comment, and we’ll share a prioritized field list.

Protect Your Audit Trail

Ensure your systems retain versions, reviewer notes, and evidence attachments. During one audit, a saved calculation memo ended a dispute in minutes. Subscribe for our monthly checklist on audit-ready documentation practices that strengthen strategies for managing tax compliance.

Risk Management: See Issues Before They Become Penalties

List risks like late filings, wrong taxability, or unregistered nexus, then assign owners and due dates. Review monthly. Share your top three risks, and we’ll respond with mitigation tactics specific to your strategies for managing tax compliance.

Risk Management: See Issues Before They Become Penalties

Re-run reconciliations, sample invoices, and verify certificates. Stable systems still drift. One company found a silent tax code override after a routine test. Subscribe to get our quarterly control-testing prompts delivered to your inbox.

Multi-Jurisdiction Mastery: States, Countries, and Indirect Taxes

Set thresholds, monitor economic nexus, and pre-plan registrations before thresholds are crossed. A coffee roaster avoided back taxes by tracking marketplace sales early. Ask for our nexus tracker to strengthen your strategies for managing tax compliance.

Multi-Jurisdiction Mastery: States, Countries, and Indirect Taxes

Clarify place-of-supply, invoice content, and reverse-charge situations. Align ERP tax codes with legal rules. A SaaS founder wrote us after reclaiming VAT thanks to better invoice fields. Subscribe for cross-border tips each month.

Deadlines, Payments, and Cash Flow: Stay Timely Without Stress

Balance Cash with Compliance

Align remittance timing with internal approvals and bank cutoffs. Avoid last-minute wires and portal surprises. One team scheduled payments two days early and never looked back. Comment for our payment timing checklist.

Use Reminders and Capacity Buffers

Set layered reminders: preparation, review, payment, and confirmation. Add buffer days for holidays and system maintenance. This single practice transformed a chronically late filer into a steady performer. Subscribe for calendar prompts.

Learn from Near-Misses

After each cycle, document what almost went wrong and how you fixed it. Turn lessons into checklists, training, or controls. Share one near-miss below, and we’ll suggest two process improvements by tomorrow.